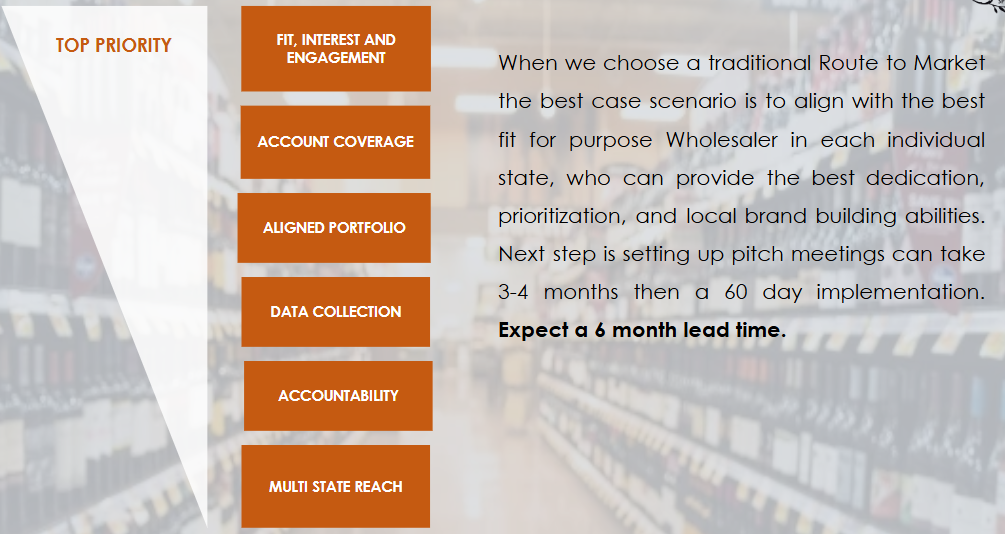

Route to Market

TOPLINE SUMMARY

- THE US HAS OVER 600,000 WINE AND SPIRITS BRANDS

- In 2023 the TTB approved 177,6K new products

- Wine was 113.7K, Beer was 40.9,Spirits was 23.1K +3%

- WHILE ONLY 935 DISTRIBUTORS NATIONWIDE

- The top 10 distributors are responsible for almost 82% of the volume and value

- The top 5 wholesalers seek strong established brands with predictable sales

- Smaller Wine Supplier’s are faced with Contractual agreements with heavy

- Pay out fines 5x GP and long-term 10 year agreements with 30% or Higher GP expectations

- Many going thru Sku rationalization (SGWS, Winebow and MS Walker)

- SGWS IS THE NATIONS LARGEST WHOLESALER IN 44 STATES

- Accepted only 2% of proposed brands in 2023

- Being selective allows them to focus on existing supplier growth

- 56% of all new brands accepted in 2023 were diverse owned

- WHOLESALER CONSOLIDATION CONTINUES

- RNDC already in 43 states

- Breakthru already in 15 states recent acquisition CA Wine warehouse

- Martignetti recent acquisition Hartley and Parker now in 6 New England states

WHOLESALER CONSIDERATIONS

WHOLESALER NEW SUPPLIER CONSIDERATIONS

- Price Structures

- FOBs, Distributor Margins with targeted Shelf Price-

- with min GP 28-33%

- No DA or Price support

- Info on Stateside warehousing

- List if existing on/Off Premise commitments

- Last 12 months volume by state

- Marketing Plan & Local Spending funding

- Supplier Manpower deployment in market

- Detailed Launch Strategy

- Volume Expectations

- Shipment / Depletion / Distribution / Channel

- Press Kit with Product & Media Targets

- Reviews & Accolades

- Details on Business Ownership…

- Craft certified / Minority / Woman / LGBT / Veteran / Disability

- Proposed Brand Expressions

- 3 samples of each

- Point of Origin

- List of Competitive set

- Support Materials (POS/SWAG)

- Planned Distributor Programming

- Brand Objectives

- Lifestyle/Occasion-Consumption Occasions

- Activation Plans-Events, sponsorships

- PR / Communication Plans

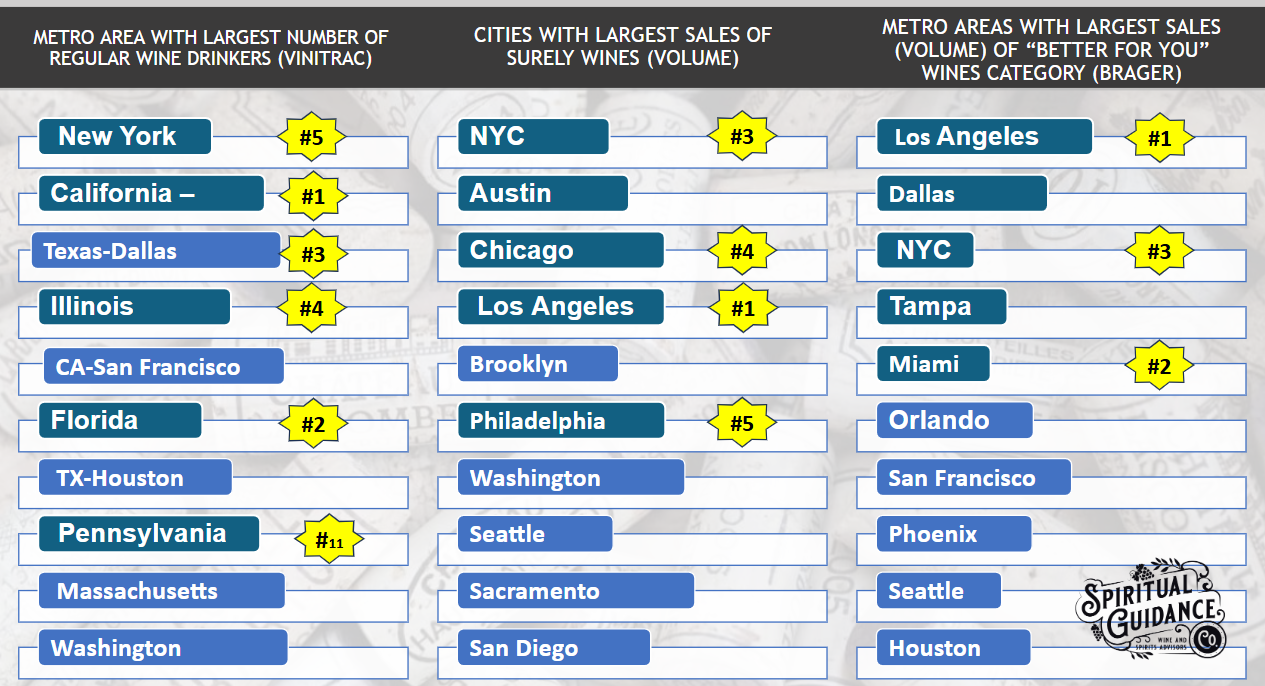

Market Identification

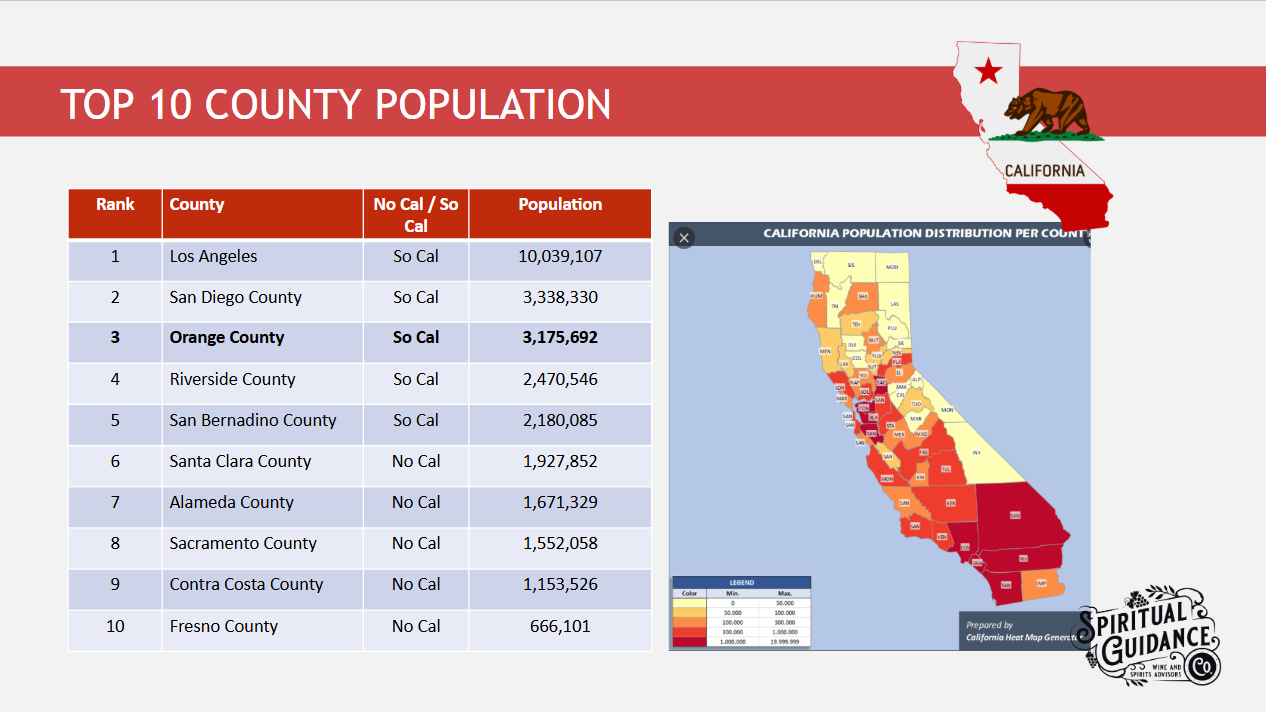

RECOMMENDED INCUBATOR MARKETS

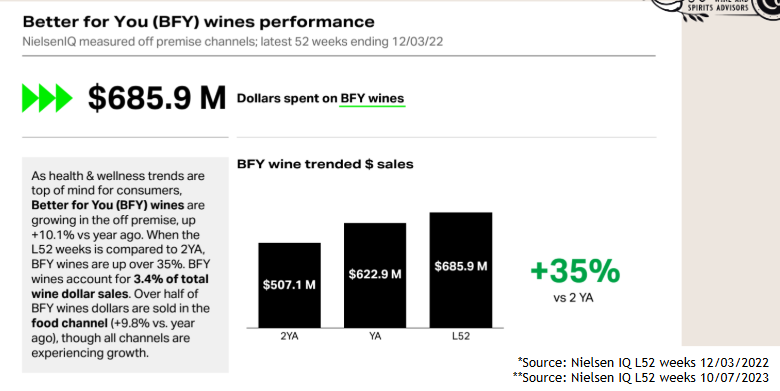

BETTER FOR YOU WINE DATA

- In Dec. 2022, Better for You (BFY) wines posted a +10% dollar increase (+35% over 2 years) with half sold in the food channel*

- More recent data shows that through October 7, 2023, BFY wines were again up over 10% in NIQ channels, compared to a year-to-date volume decline of nearly 5% for the total wine industry.**

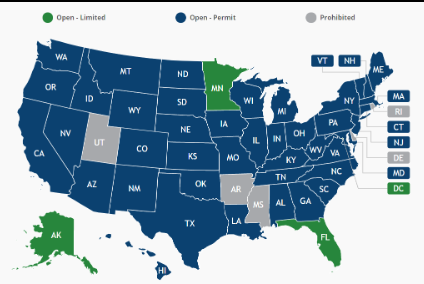

DIRECT TO CONSUMER # 2

Domestic wineries largely can operate tasting rooms and direct to consumer sales by means of their production licenses

Domestic wineries can now ship their products to 46 states and territories. In exchange, the wineries agree to get licenses in the states they ship to, to pay those states’ taxes, to restrict sales to minors, and to otherwise abide by the jurisdiction of those destination states.

More details at: https://wineinstitute.org/our-work/compliance/dtc/

Find details by state on permits, volumes, excise tax etc.

- Get creative to recruit consumers-leverage influencers

- Acquire rich customer data and stay relevant to your audience

- Personalize the experience with you audience

- Click and engagement drive consideration

- Drive results purchase, repurchase and recommend

- Need to select a strong agency partner Salisbury Creative or Wagstaff (storytelling and Community building) to drive 500-1000 leads per month

- Heavy investment in targeted ads

- Wine direct –Scale and breadth with end-to-end solutions

- Consider fractional DTC and Marketing services benefit smaller companies who can add a seasoned veteran to their team at a fraction of the cost of a full-time person. Azur can deliver best-in-class business advisory services through a team deeply experienced in every aspect of the beverage industry.

SOCIAL MEDIA APPROACH

INITIAL AUDIT & STRATEGY

A detailed, data-based review of what is and isn’t working on the current social channels, and our strategy for moving forward on the accounts delivered prior to calendar building.

CONTENT CALENDARS & POSTING

scheduled bi-weekly content calendars to be implemented throughout engagement, focusing on maximizing post copy SEO and creative potential in relation to organic, algorithm-boosting methods

CREATIVITY & DATA

The execution of assets as a storytelling tool combined with data insights to inform the creative strategy. User Generated Content and photography/videography coordination are all at our disposal.

ORGANIC SEARCH ENGAGEMENT

Social listening aimed at optimizing content to appear more frequently within organic search on Instagram while identifying and engaging potential followers.

INFLUENCER RELATIONS

Build relationships with influencers to secure top tier talent for a wide array of collaboration formats.

COMMUNITY MANAGEMENT

Liking, commenting and overall engagement strategies across platforms, including sharing to Instagram Story. Building and engaging with dedicated hashtags, updating with data-backed analysis.

SOCIAL MEDIA BOOSTING & ADVERTISING EXECUTION

Agency to generate the strategy and creative copy to best lead prospective consumers through the sales funnel with targeted advertising campaign management, platform data analysis and execution.

CAMPAIGNS (INFLUENCER TAKEOVERS, CONTESTS, ETC.)

Manage the planning, execution, and tracking of all social initiatives including ideation and development of social media-specific campaigns, contests, and events.

SOCIAL MEDIA

- 2-4 posts per week across Instagram, Facebook, Pinterest (duplicated)

- Content based on storyboarding

- 5-8 Instagram Stories per week, in addition to always on community sharing

- LinkedIn strategy and monthly creative tasks to create a standardized B2B program on the platform

- YouTube and TikTok strategy with full video execution

- Daily community management and organic growth engagement

- M-F during business hours, maintenance for urgent needs on weekends

- Implementation of suppression lists across platforms and ongoing maintenance

- weekly team progress calls

- Monthly analytics reporting & access to live dashboard

- Management and deployment of social media boosting and paid social media ads (FB & IG)

- Setting up email marketing subscriber funnels & creative / copywriting /deployment of up to 2 emails per month

Data Analytics Requirements

Data Generates Revenue

Technology will shape and define success

Define where to deploy resources against the opportunity

SYNDICATED DATA SOLUTIONS

Distribution in grocery, mass merch or liquor chains requires a syndicated data solution to monitor sales metrics and to provide

data to gain additional chain listings

Two choices: Nielsen and Circana (IRI)

Nielsen and Circana data is typically delivered via raw data monthly Excel spreadsheets. Companies using these plans typically

are staffed heavily with analyst teams and IT infrastructure

Coverage by both companies is similar except only Circana provides access to Kroger scan data – largest US grocery chain and now

merging with Safeway/Albertsons if it clears anti-trust

Access to additional data through Kroger Gateway (details on specific banners and other deep dives)

Fintech offers a different plan/interface for Circana versus raw data

Graphic interface vs, Nielsen standard reporting on Excel; Web-based delivery

135 measures (deep lens into market insight)

800 GEOGs (broad spectrum of channels/coverage)

Dedicated support desk with timely response; unlimited inquiries, downloads, saved views

Weekly refreshes (Nielsen monthly with longer lag time)

Currently a plan for spirits and wine access with 21 markets or banners for wine and xx for spirits is $44,000 or $3,666 monthly.

For wine only with fewer geogs cost could be more like $2,000 monthly